Clinica Baviera ($CBAV) - Seeing beyond

Founder-led Spanish company in a growing industry at an attractive valuation

Introduction

Clínica Baviera is an ophthalmology group founded in 1992 in Spain by Eduardo Baviera (current CEO) and other members of Baviera´s family and friends. It specializes in refractive surgeries like LASIK, cataract surgeries, and treatments for various eye conditions as myopia, hyperopia, and astigmatism. The company focus on services that are not covered by public health systems such as surgeries to correct the need for glasses or contact lenses.

Clínica Baviera began its operations in Spain but started expanding internationally several years ago and is currently present in multiple countries (Spain, Germany, Austria, Italy, and recently in the UK after acquiring a group of clinics in June 2024).

Its stock trades on the Spanish stock market and currently has a market capitalization of approximately €450 million, with 90% of shares held by majority shareholders (the founders and a Chinese ophthalmological group), resulting in low trading volume on the market, averaging less than €100,000 per day, far from major investment funds.

Ophthalmology sector

The World Health Organization estimates that by 2050, half of the global population will be myopic, with the issue spreading at an unprecedented rate.

The different markets where the Group operates, according to the type of treatment provided, are as follows:

Refractive defects: Surgical techniques to correct ocular defects (such as myopia and astigmatism) primarily affect middle-aged people, with the affected population increasing exponentially due to prolonged exposure to electronic devices and screens. As an anecdote, in June 2024, CBAV identified Seville, a beautiful city in southern Spain, as the 'myopic city of Spain' based on research showing approximately 50% of the population is already myopic.

Presbyopia: An age-related condition where the eye gradually loses the ability to focus on nearby objects, affecting nearly 100% of the population over 45 years old.

Cataracts: A condition where the eye lens becomes cloudy, leading to vision loss. This condition is covered by the National Health Systems in Spain, Germany, and Italy.

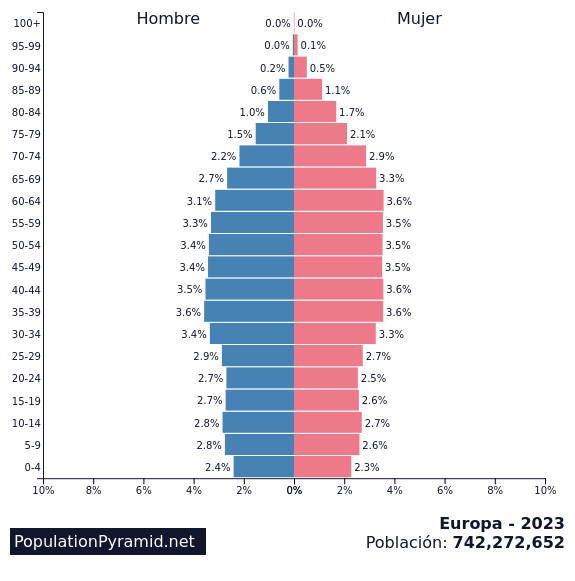

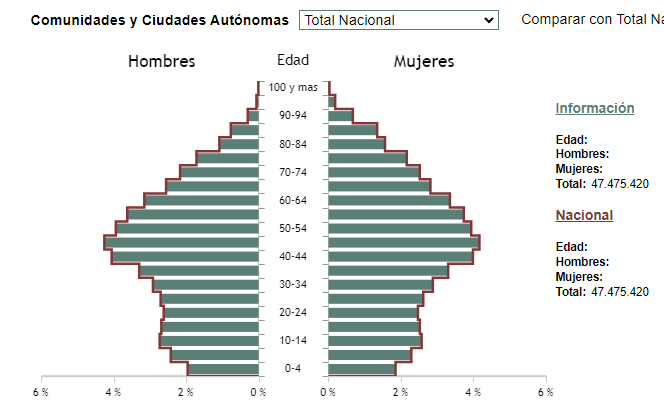

The aging population contributes to an increasing demand for treatments targeting age-related conditions such as presbyopia and cataracts.

As seen in the previous population pyramid charts, the demographics favor Clinica Baviera, particularly in Spain. Moreover, we anticipate increased potential for CBAV due to saturation in public health coverage, where an aging population will lead to longer waiting lists for treatment. This suggests a natural shift from public institutions to private companies like CBAV.

Market value proposition: Providing good service at competitive prices

Clinica Baviera is the leader in the private ophthalmic sector in Spain, holding over 25% of the market share and operating more than 75 clinics. The ophthalmological market within Spain is concentrated, characterized by a mix of large corporate groups and individual clinics. Competitors to CBAV include Vista Oftalmólogos with 55 clinics, Oftalvist with approximately 45 clinics, and Miranza Group with more than 35 clinics, which was acquired by Veonet in 2022 for €250 million (valued at 14xEBITDA) from a Private Equity firm.

In international markets, Clinica Baviera also maintains a strong presence as one of the top players. In Germany, it holds an estimated market share of over 20%, although the market leader is the Ober Scharrer Group with more than 130 clinics. And in Italy, CBAV commands around 15% of the market share.

Clinica Baviera's value proposition is to provide treatments that are well-regarded by the population at competitive prices. For instance, in Spain, patients can “say goodbye” to glasses for less than €1,000 per eye. The company enjoys strong customer recognition, evidenced by its superb rating of over 4.5 out of 5 stars in Google reviews.

Digging into the business and financials

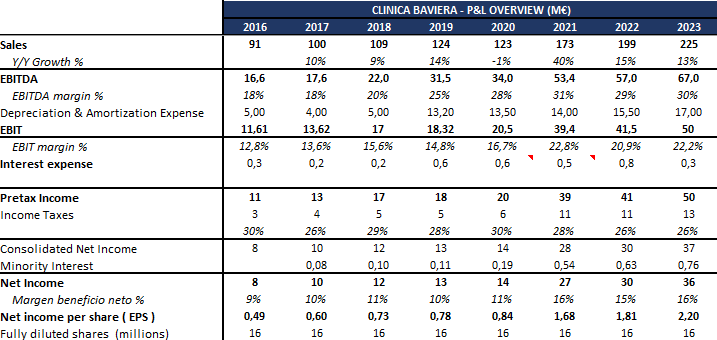

Clinica Baviera has demonstrated robust revenue growth in recent years, achieving a 16% compound annual growth rate (CAGR) in revenues and earnings per share over the last 5 years.

During the COVID-19 pandemic, despite operating in a sector categorized as 'health discretionary', where most services are not covered by national or regional public health systems, CBAV managed to maintain its revenue levels and sustain profitability. In fact, the company emerged stronger post-pandemic.

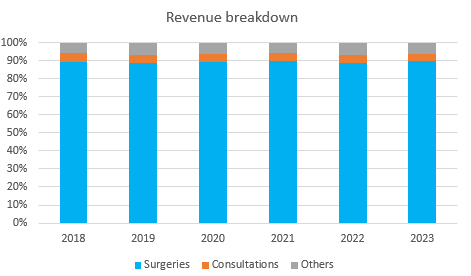

The company generates revenue through three main streams:

Surgical interventions (over 90% of revenues)

Consultations (4%): Ophthalmological diagnostics

Other services (6%): Rental of surgical space and ancillary services

The sales evolution has been strong in recent years, with growth observed in every country where Clinica Baviera operates. Following the virus period, the company experienced acceleration in sales and intensified its international expansion efforts, while maintaining Spain as its primary market and hoping to sustain this momentum going forward.

The EBITDA margin varies across countries, with Clinica Baviera achieving higher margins in Germany and Spain (around 31%) compared to lower margins in Italy (around 17-18%). Italy presents a more fragmented and competitive market where Clinica Baviera has less scale yet and weaker position.

The global number of clinics has been increasing at a steady pace, with Clinica Baviera opening between 5 and 7 clinics per year in recent years, a trend I expect to continue in the future. Despite CBAV's expanded presence in Spain, I believe there is still room for further expansion in spanish territory.

Establishing a new clinic in Spain ranges in cost, starting at €0.5 million for a satellite clinic and up to €1.5 million for a surgical clinic. In Germany and Italy, these investments rise to €0.7 million for a satellite clinic and €2 million for a surgical clinic.

Additionally, the average revenue per clinic has increased in every country, optimizing clinic capacity year over year, with particularly notable improvements in Spain, where the company holds its strongest brand position, scale and expertise.

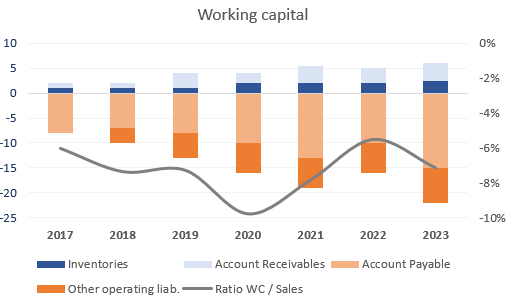

Clinica Baviera's business model allows a negative working capital, with low inventory levels and customers typically making payments on the day of treatment. The average time it takes to collect payments from customers is less than 4 days, while Clinica Baviera's average period for paying suppliers is approximately 32 days. This fact allows the company to finance daily operations and help clinic expansions using customer payments.

The balance sheet position is very healthy with no net debt (excluding leases), placing Clinica Baviera in a strong position to continue investing in the opening of new clinics and international expansion.

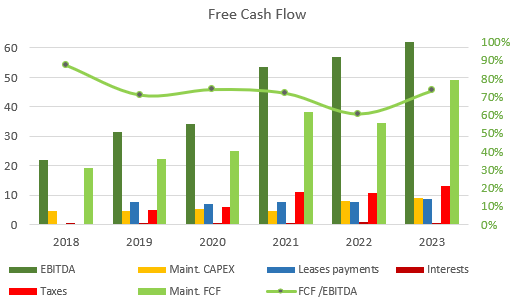

The Free Cash Flow to EBITDA conversion is approximately 70%, taking into account an estimated maintenance CAPEX of ~4% of sales and total capex ~7-10% depending the number of new openings. Lease payments in recent years totaled between €7.5 million and €8 million, covering rental expenses for offices and clinics. The robust generation of free cash flow enables the company to reinvest in the opening of new clinics and distribute a generous dividend yielding over 5% to shareholders.

Management history and shareholder movements

In 2007, the Baviera family decided to launch an IPO to accelerate the international expansion of Clínica Baviera, entering the Italian market and acquiring the Care Vision group in Germany. In 2017, the Chinese group Aier Eye Hospital Group launched a takeover bid for a 90% stake in Clínica Baviera at a price of €10.35 per share (10x EV/EBITDA FY16), ultimately acquiring approximately 87% of the stake, with the Baviera family and founders retaining 10% of the share capital. In July 2018, Aier Eye placed a 7% stake through an Accelerated Bookbuilding (ABB) process to enhance market liquidity based on spanish regulator requirements, resulting in the group currently holding a 79.8% stake in Clínica Baviera.

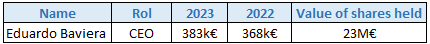

The CEO&Founder salary is considered reasonable given the company's strong performance and track record. Also, he holds a significant amount of shares relative to his remuneration, well aligning his interests with those of the shareholders

To summarize, Clinica Baviera's CEO is the founder and pivotal figure behind its current success, but, as a majority shareholder we have a chinese institution that is one of the largest networks of ophthalmology hospitals globally, and I do not have a good rapport with a chinese majority shareholder having +80% of shares, perhaps biased by my past bad experiences with chinese executives and dishonest actions.

Latest strategic move: Continuing international expansion into the UK

In June 2024, CBAV acquired the UK ophthalmologic group "Optimax" for €11.73 million, adding 19 clinics to its portfolio and entering a new market with clinics located in major UK cities such as Liverpool or London. This strategic move appears promising, as Optimax enjoys a strong client reputation, reflected in its Trustpilot reviews of 4.7 stars.

Currently, Optimax is not profitable, reporting a loss of -€1 million in 2023. However, in 2021, it achieved EBITDA margins of 18%. This indicates that there is potential for management to improve the situation and restore profitability. We will see…

Risks and considerations

Brand recognition: Clinica Baviera holds a strong market leadership position in Spain with excellent reviews, but any critical surgical operation or negative incident could significantly damage its reputation in the highly sensitive healthcare sector.

Competition and surgery prices. Despite entry barriers and the need for specific expertise in the ophthalmological industry, surgery prices have remained relatively stable among major groups in recent years due to intense competition.

CEO&Founder: Eduardo Baviera is at the helm of the ship and the key person behind the strategy and success of Clinica Baviera. Although he is not very old (57 years), his potential retirement should be a key point to analyze.

Chinese ophthalmological group as the majority shareholder: Holding an 80% stake, the Chinese group faces a significant decision regarding the potential acquisition of the remaining shares at potentially unattractive terms. I do not see this highly probable as they had the opportunity in 2018 when Spanish regulators required them to either acquire the remaining shares or increase the free float to enhance market liquidity. Instead, the group chose to reduce its stake by 7% to improve market liquidity.

UK expansion: Recently, CBAV acquired Optimax Group in the UK, which operates 19 clinics across the country. Currently, Optimax is experiencing profitability challenges, necessitating a turnaround effort from Baviera's team. Integrating operations and navigating these challenges might not be an easy game.

Valuation and final thoughts

Why is the stock undervalued? Some ideas and thoughts…

Clinica Baviera can be seen as a cyclical business as most of the services are not covered by national health systems, but the company operates in a industry with good growth prospects and favorable tailwinds

The low free float keeps the stock away from large institutional investors

The stock trades on the Spanish secondary stock market, which may limit exposure and attractiveness to international investors

There are no listed companies considered close peers of Clinica Baviera. While there are clinical groups traded in countries such as Malaysia, Taiwan, or China, they differ significantly in size, service offerings, and geographic focus, making direct comparisons challenging.

Below are a couple of transactions to provide some colour about current valuation:

Miranza Group's acquisition by german company “Veonet” in 2022 was valued at 14x EV/EBITDA, despite having lower sales and margins than Clinica Baviera. (35 clinics in Spain, 100M€ sales and 18% EBITDA margin)

Aier Eye's takeover bid for 80% of Clinica Baviera in 2017 was at a valuation of over 10 times EV/EBITDA (pre-IFRS FY'16). Applying a similar multiple to adjusted EBITDA pre-IFRS FY'23 suggests an intrinsic value +50% higher than the current price (26,5€/share)

To summarize, Clinica Baviera operates in a sector with favorable trends and is currently trading at approximately 11x P/E for 2023 under my estimations or 12 times on a last twelve months (LTM) basis. I expect revenues and earnings per share to grow at around 10% over the coming years following the current trend of open new clinics and international expansion. Additionally, Clinica Baviera has a robust balance sheet with net cash and offers a stable dividend yield of over 5%.

What multiple should a company like this trade at? Considering the factors mentioned (low liquidity, location and other considerations) I think that applying a conservative multiple like 15x P/E or EV/FCF could be the right approach to expect an annual IRR of ~ 20% over the next 3-5 years.

DISCLAIMER: The posts made on this platform are not recommendations to buy or sell. All communications are solely for informational and educational purposes. Each investor should conduct their own due diligence.

Amazing work and shareholder too ☺️

Very interesting company. Do you know how regulation works in the individual countries? I always thought in Germany there are no clinic chains are allowed but only individual doctors. But that may be wrong.